Financial Self-Care Checklist

This post may contain affiliate links for which I may earn a small commission. This means shopping through these links supports my blog at no cost to you. Please read my full policy. Thank you!

Financial self-care is an important part of taking care of yourself.

Money management can be difficult and stressful. But the good news is that financial self-care does not have to be complicated.

With the right tools and resources, it’s possible to establish healthy money habits and take control of your finances.

This post will discuss why financial self-care is important for financial success and overall well-being. We will also discuss some specific actions you can take to look after your financial well-being.

WHY IS FINANCIAL SELF-CARE IMPORTANT?

Many people's idea of self-care is bubble baths and going to the spa. While those things are nice, self-care is more than that. Financial health is an important part of self-care. It affects your overall health and well-being, just like other forms of self-care.

While it’s easy to put financial stress out of your mind, the truth is that it can have a far-reaching impact on almost every aspect of your life.

From mental health and physical health to relationships and career decisions, financial matters can make or break your quality of life.

So, taking control of your finances and establishing good habits through financial self-care is essential for a happy and healthy life.

Financial self-care involves activities such as:

Setting financial goals

Budgeting

Monitoring spending habits

All these components are important in helping you achieve financial stability and health.

HOW CAN I PRACTICE FINANCIAL SELF-CARE?

Financial self-care involves controlling your finances, setting goals, creating a budget, and monitoring spending habits.

Financial self-care is about doing something your future self will thank you for today.

When developing a financial self-care routine, starting slowly rather than trying to make several changes at once is important. This will help you not feel overwhelmed. Adding one thing at a time to your daily routine often works best.

Here are some specific things you can do for financial self-care:

1. SET FINANCIAL GOALS

Setting financial goals is an integral part of practicing financial self-care. This is because it helps you to stay focused on your long-term objectives.

By setting and monitoring financial goals, you can make decisions based on a set plan rather than impulse or panic.

Financial goals also measure success, as you can measure how close you get to your objectives.

Having concrete short and long-term goals can help keep you motivated. This can help because even when times may be challenging or discouraging, you know that there's still a larger goal in sight that will keep you moving forward.

Decide what you want your money to do for you, and create attainable goals towards achieving those aims.

2. ESTABLISH A BUDGET

Establishing a monthly budget is an essential tool for practicing financial self-care.

A budget helps you control your finances and ensure you are not overspending or taking on too much debt.

By creating a personalized budget, you can identify the areas where you could be spending less and adjust where needed.

This lets you focus on what's important in your life and ensures you manage your money well.

Keeping up with your budget also serves as a helpful reminder of how far you have come with saving and how well your financial plans are working out.

3. TRACK SPENDING HABITS

By tracking and monitoring where you spend your hard-earned money, you can ensure you are on the right path to achieving your financial goals.

Doing this allows you to identify unnecessary expenses and adjust as needed to save money in the long run.

Monitoring your spending also helps ensure you are not taking on too much debt. This is because keeping track of what you owe and when it should be paid off gives you better control over your finances. This can help serve as a powerful reminder of how far you have come with debt management or working toward financial stability.

You May Also Enjoy:

150 Vision Board Ideas to Bring Your Dreams to Life

4. LIVE BELOW YOUR MEANS

Many people recommend living within your means. But I think it’s helpful to take it a step further and live below your means.

Living below your means is an important part of financial self-care.

When you live below your means, you can save more money and use it to meet future goals. These goals could include things such as buying a house or car. It could also be investing for retirement, paying off debt, or other long-term financial goals.

Living below your means also provides a level of financial security. This is because you know you have the resources to cover unexpected expenses or emergencies.

Living below your means also helps prevent you from accumulating unnecessary debt and buying things you don’t really need.

5. LIVE WITHOUT A CREDIT CARD

A credit card can be a helpful tool if used responsibly. But it can also lead to overspending and debt accumulation if not managed well.

Paying with cash or debit instead of credit can help you stay on top of your spending. It can also ensure that your purchases are within your budget.

Also, it prevents the risk of racking up high-interest charges and late fees from unpaid bills.

Living without a credit card allows you to maintain better control over your finances and stay within budget.

You May Also Enjoy:

10 Easy Ways to Budget for Christmas

7 Ways to Teach Your Kids About Money

6. GET CREATIVE

Practicing financial self-care doesn’t mean that you can’t have fun! In fact, it’s good to allow yourself to have a good time on your financial journey. This will help ensure that you don’t feel as if you are missing out on anything.

When it comes to practicing financial self-care, there are plenty of ways to treat yourself without spending money. Or at least spending very little.

Get creative and think of things you can do at home or around town that won't break the bank.

Here are a few ideas:

Cook your favorite meal.

Take a free online course.

Get outdoors for a picnic.

Attend free community events.

Make time for hobbies like photography, painting, writing, or crafting.

Enjoy quality time with friends and family.

Curl up with a good book or movie.

Listen to music or podcast.

Whatever you choose, allow yourself to treat yourself without feeling guilty.

Self-care should be an enjoyable experience - and it doesn’t always have to come with a price tag!

7. NEGOTIATE BILLS

By negotiating your bills, you can save money and get better deals on services such as cable, internet, and phone plans.

Negotiating can also help reduce the interest you pay on loans and credit cards.

Negotiating bills is a good idea because it can be a powerful way to manage your finances and ensure you get the best deal possible.

8. PRACTICE DELAYED GRATIFICATION

Practicing delayed gratification is a key component of financial self-care.

You can better manage your finances by learning to embrace the practice of delaying purchases in favor of saving money. You can also build up an emergency fund for unexpected expenses.

Delayed gratification also helps to reduce impulse buying, which can cut down on the amount you spend on things that are not needed.

Also, you can make smarter spending decisions by understanding that there may be opportunities to get some items at better prices or discounts later.

Putting off short-term temptations to reach long-term goals is important for financial wellness.

Related: How Women Can Improve Their Money Mindset

9. LEARN ABOUT THE MARKET

Learning about the market and staying up-to-date with any news or developments related to finance is an important part of practicing financial self-care.

By gaining knowledge of different financial instruments, assets, and markets, you can make better decisions when managing your own finances.

This can help you make more informed investments that may yield higher returns. It can also explain how different economic events may affect your current wealth.

Learning about the market can also help you develop strategies for reducing risk. This helps so that in the event of any losses, you can minimize them through smart decision-making.

10. MAKE SMART INVESTMENTS

By investing in a well-researched and diversified portfolio of assets, you can ensure that any potential losses are minimized. You can also ensure that the chances of gains increase.

Making wise investments helps you grow wealth over time to achieve your long-term financial goals.

Smarter investments can provide tax benefits as well.

Smart investing also helps cushion the effects of inflation due to market volatility. So even if the markets dip, your savings may remain largely unaffected. So don't be afraid to contribute to those investment accounts!

11. GET HELP WITH DEBT MANAGEMENT

If you find yourself in a situation where you have accumulated high levels of debt, it’s essential to seek help from a financial advisor or other financial experts.

Doing so can give you the insight and guidance needed to shift your financial situation in a more positive direction.

They can suggest different strategies that may help manage your existing debt. They can also offer advice on avoiding similar situations in the future.

Seeking out debt management help early on can save you from spending large amounts of money on late fees and penalties due to neglected payments or defaulting on loans.

If you’re overwhelmed and don't know where to start with debt management, getting help from a certified financial planner or another professional is an excellent idea.

Related: How to Pay off Debt with Low Income

12. AUTOMATE PAYMENTS

By taking the time to set up automated payments for your bills, you can simplify the process. You can also reduce the stress of keeping up with multiple payments. Automating payments reduces the risk of missing due dates or being hit with late fees.

Also, regular payments can help improve your credit score over time. This is because lenders generally see regularly paid bills as a sign of creditworthiness.

Automating payments can help reduce spending by helping keep track of your outgoing expenses and preventing impulse purchases.

13. ESTABLISH AN EMERGENCY FUND

An emergency fund can help you cope with unexpected expenses without taking on extra debt, particularly during an economic crisis or sudden job loss.

It also reduces the chance of relying on credit cards for cash advances during these unforeseen events.

An emergency fund provides increased financial security and peace of mind as a cushion should any major expenses arise.

Setting up an emergency fund requires discipline and dedication. But the long-term gains make it worth investing time and effort.

↓PIN IT FOR LATER!↓

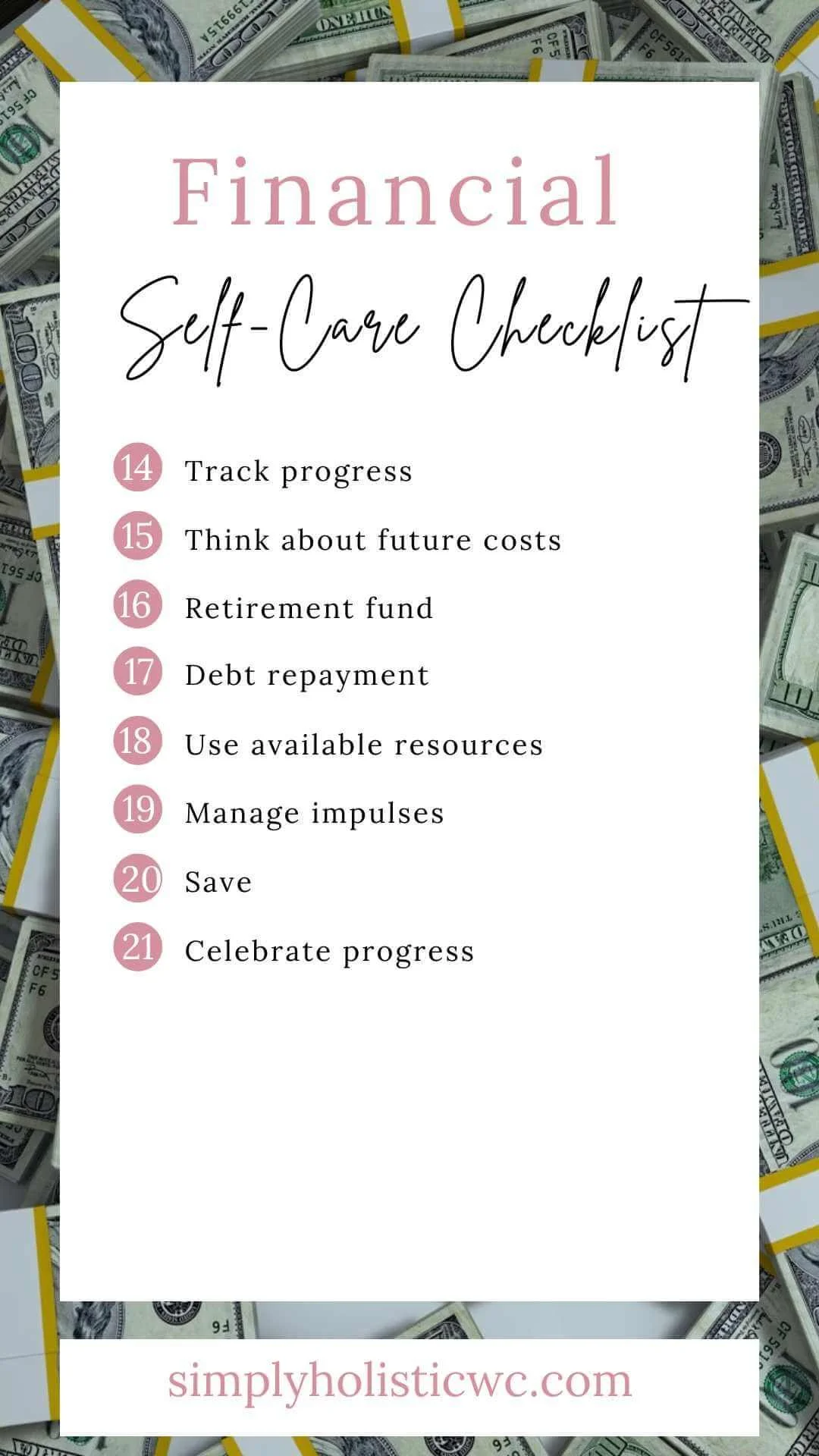

14. TRACK PROGRESS

You can better understand where your money is going by tracking your monthly income and expenses.

You can also become aware of any potential problems early on. This will help you identify areas where you may need to cut back or adjust your spending habits.

Regularly reviewing your finances can help ensure you remain on track to meet financial goals. It can also give you a clear idea of how much money is available to invest in the future.

Tracking progress can provide accountability, an excellent motivator for maintaining sound financial habits in the long run.

Related: 7 Money Management Tips for Beginners

15. BE MINDFUL OF FUTURE COSTS

By preparing financially for future expenses, such as retirement and college tuition, you can meet your goals.

Having a plan in place ahead of time will help to reduce the amount of stress associated with large purchases or life changes.

Being aware of potential roadblocks in the future can help you adjust your plans as needed. It can also ensure that any necessary steps are taken well before the actual expense arises. Taking time to plan now can bring great dividends down the road.

Consider the long-term costs of any purchases, such as a high-interest rate and fees.

Also, ensuring that you have health insurance can help you avoid costly medical expenses.

16. CONTRIBUTE TO YOUR RETIREMENT FUND

By setting aside money for the future, you can ensure that you have enough saved for when you retire.

Contributing to a retirement savings account can also help to reduce your taxable income. This allows you to save more in the present and enjoy more tax advantages throughout your life.

It's a smart way to prepare for a future where you may be unable to work or earn a salary due to health issues or other circumstances.

17. FOCUS ON DEBT REPAYMENT

Prioritizing debt repayments, such as student loans, credit accounts, and auto loans, is an important part of financial self-care.

Paying off debt helps to reduce the amount of money you owe, freeing up more money for other expenses.

Paying back debt can also help you build a good credit score. This can make it easier to get loans in the future and even get a lower rate on your existing loans.

Paying back debt also shows that you are responsible with money and have the discipline to repay what you owe on time.

If you have loans or credit card debt, develop a plan for getting out of debt fast.

The snowball method, in which you pay off debts with the lowest balance first, can be an effective strategy.

The debt avalanche method, which means you pay off the high-interest debt first, can be a good strategy as well.

These methods can help you repay debt and stay motivated in the process.

18. USE RESOURCES AVAILABLE

Many financial resources can help you become better informed about how to manage your money and make wise financial decisions.

These resources could be online courses, books, articles, or free workshops.

They could also include seminars offered by organizations such as banks and credit unions.

These resources can also help you develop long-term strategies for dealing with debt, creating budgets, investing for retirement, and other important financial goals.

Also, take advantage of programs that help with your finances. These include state or federal grants or employer-sponsored savings plans.

19. MANAGE IMPULSES

Impulse purchases can add up fast and cause you to overspend, leading to a worsening money situation.

So, it's important to be mindful when purchasing items you don't need.

Practicing mindfulness and self-awareness regarding spending can help you become more aware of the motivations behind your spending choices.

This will enable you to make more informed decisions about your finances and save money in the long run.

20. DON’T BE AFRAID TO SAVE

By setting aside money each month, you can build a financial cushion that can help protect against unexpected costs. Even small amounts can add up over time and provide valuable security in the long run.

Also, putting money in savings accounts allows you to take advantage of good investment opportunities or pursue plans that require some upfront costs. This includes starting a business or taking a vacation.

Don't be afraid to save. It can be one of the most powerful tools in your financial toolbox!

Save up for big purchases like cars or houses to reduce the amount of debt you take on later.

21. CELEBRATE YOUR PROGRESS

Celebrating your progress in financial self-care is an important part of your financial self-care journey!

Taking charge of your finances can be daunting. So, recognizing your achievements along the way is key to staying motivated.

Every time you set up an emergency savings account, pay off a debt or take steps to reduce spending, pat yourself on the back. It's something to be proud of!

Celebrate small wins and big successes alike. They all add up to create a more secure financial future.

CONCLUSION

Financial self-care is the best way to take control of your finances and build a secure financial future.

It's also crucial for your financial well-being. Challenge yourself to practice one act of financial self-care daily, big or small. This is an excellent way to ensure that you are making progress without feeling overwhelmed.

Negotiating bills, setting up an emergency fund, tracking spending, and other steps will help you take charge of your money and feel more secure in the long run.

Don't forget to celebrate successes along the way. After all, taking control of your finances is something to be proud of!

Remember that small changes add up to big results!