How to Prepare for Retirement

This post may contain affiliate links for which I may earn a small commission. This means shopping through these links supports my blog at no cost to you. Please read my full policy. Thank you!

Are you looking for ways to prepare for retirement and secure your financial independence?

It's never too early to start planning and setting yourself up for the financial security of a well-prepared retirement plan.

Whether you're just starting out or have been working hard at planning for retirement during your career, understanding the key steps that can help ensure a successful transition into full retirement is essential.

In this blog post, we’ll discuss some of the most important aspects of getting ready for retirement and how best to approach them.

WHAT IS THE FULL RETIREMENT AGE?

According to the Social Security Administration, people used to be eligible for full Social Security retirement benefits at age 65.

But, Congress passed a law in 1983 that gradually increased the full retirement age to 67 for those born in 1960 or later.

Planning and understanding when you can start receiving your Social Security benefits are essential for maximizing your retirement income.

You can use the full retirement age calculator to determine when you can start to receive Social Security benefits.

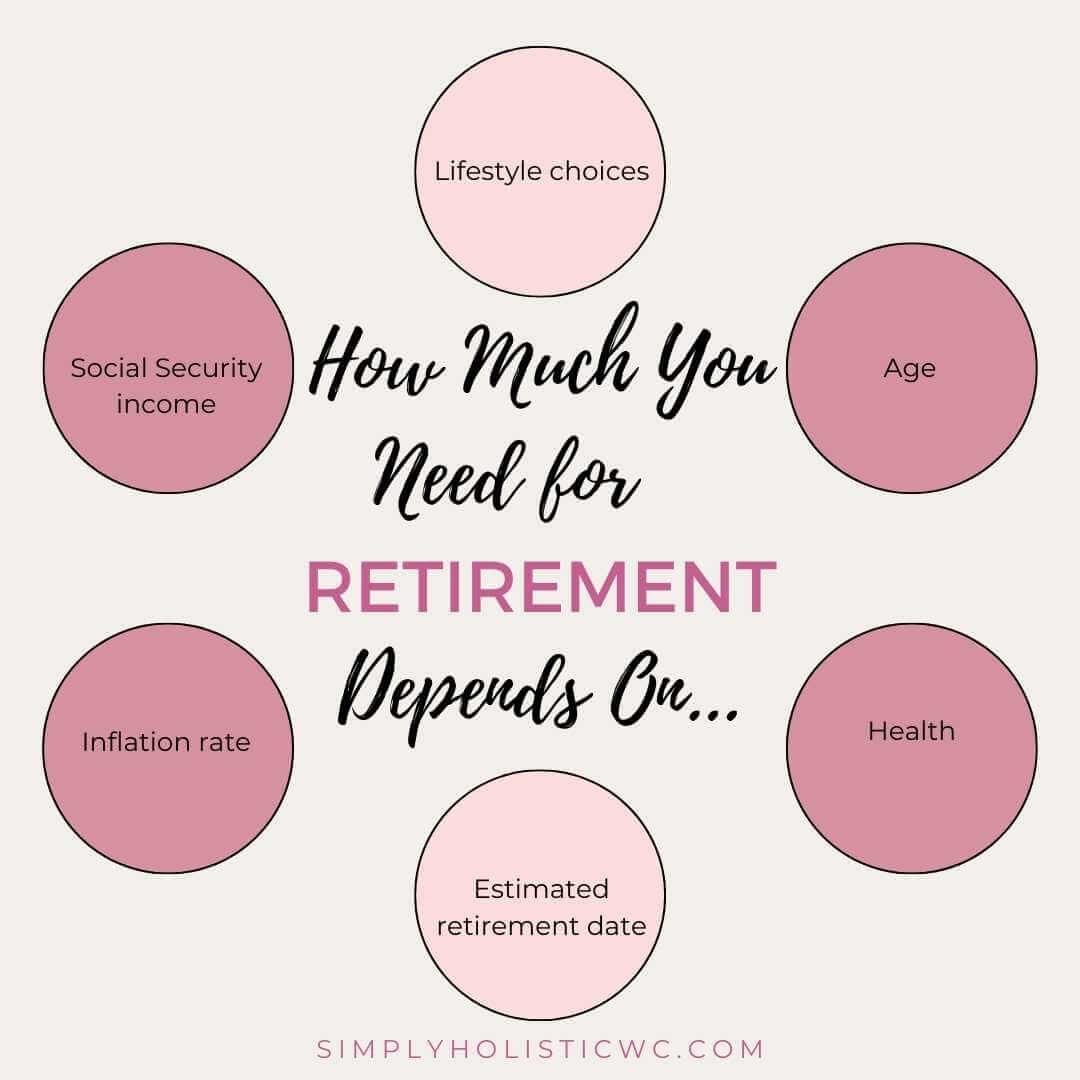

HOW MUCH DO I NEED FOR RETIREMENT?

When looking to retire, the first place to start is to know how much money you will need. This is a crucial part of the retirement planning process.

A general rule is to save enough to cover 70% to 80% of your pre-retirement income.

Note that this amount will vary depending on factors such as your:

Lifestyle choices

Age

Health

Estimated retirement date

Inflation rate

Social Security income

↓PIN IT FOR LATER!↓

Building an emergency fund is also important.

It should be separate from your retirement fund to cover any unexpected changes in the economy or medical expenses.

WHEN SHOULD I START SAVING FOR RETIREMENT?

Saving for retirement is something you should start planning for as early as possible.

This is especially important if your goal is early retirement. The sooner you contribute to a retirement investment account, the more time your money will have to grow and compound over time.

But, even if you are starting late, it’s important to set yourself up for success by making regular contributions and taking advantage of tax-deferred accounts such as IRAs or 401(k)s.

Also, look at your current situation and consider potential market changes when determining the best approach for preparing for retirement.

By following these steps and committing to a disciplined saving strategy, you can set yourself up for financial security in your later years.

WHICH ACCOUNTS ARE BEST TO SAVE FOR RETIREMENT?

There are a variety of accounts available to help you save for retirement. Employer-sponsored plans, such as 401(k)s, allow you to make tax-deferred contributions.

An IRA (Individual Retirement Account) provides an individual investment option that can be invested in stocks, bonds, or mutual funds. An annuity and a Roth IRA give more tax advantages for retirement savings.

Depending on your retirement goals and current financial situation, it’s important to research the different types of accounts and find the right fit for you.

WAYS TO PREPARE FOR RETIREMENT

1. START PLANNING EARLY

Planning is one of the best ways to ensure you are ready for retirement. It's never too early to start planning for retirement. The earlier you start, the more time you have to save and plan for your financial future.

By beginning to plan early in life, you can use compounding investment returns and maximize any benefits your employer offers.

Here are some simple steps you can take now to begin preparing for retirement:

Calculate how much money you will need to be comfortable in retirement- To do this, consider factors such as the length of your expected retirement, the average inflation rate, taxes, and Social Security payments.

Contribute to a retirement account - Maximize any contributions from your employer, such as 401(k) matching programs or other benefits designed to help you save for retirement.

Build an emergency fund - An emergency fund is crucial for retirees because it provides security during unexpected expenses or financial hardship.

Get insured - Insurance helps protect against certain risks and losses that may be incurred later in life if proper precautions are not taken beforehand.

2. CREATE A RETIREMENT BUDGET

It’s important to create a retirement budget when planning for retirement. In creating a budget, you’ll consider all your estimated retirement income and expenses.

We will go over what to consider for your income and expenses below.

CONSIDER ALL YOUR INCOME SOURCES

When planning for retirement, it’s important to identify all sources of income.

Some of the ways that you can supplement your retirement savings include the following:

Pension benefits

Disability benefits

Expected income from part-time jobs

Rental income

Social Security

Also, an important part of creating a comprehensive retirement plan is determining the following:

When you will be able to draw from these sources

How much money to expect

How the taxes on the money affect your tax burden

CONSIDER ALL YOUR EXPENSES

When calculating the amount of money you will need in retirement, consider expenses such as:

Healthcare costs

Transportation costs

Life insurance

Housing expenses

Taxes

Food

Clothing

Discretionary spending

Also, since no one knows what inflation may look like in the future, it’s important to factor potential increases in cost-of-living into your calculations as well.

By considering all these different factors in your retirement income and expenses, you can create a plan that puts you on the path to financial security during your retirement years.

An online retirement calculator can be helpful for you to get a better estimate of how much you will need in retirement.

Calculate your future needs, create a budget, and work with a financial advisor to create the best plan for accessing and managing these resources during retirement.

3. MAKE WISE INVESTMENTS

Making wise investments is a vital part of preparing for retirement. Your investment portfolio should be diversified, including a mix of stocks, bonds, mutual funds, index funds, and other investments.

This will help to spread your risk and maximize your returns over the long term. It will also help you maximize your investment return.

Reviewing your portfolio annually and adjusting it if needed is also important. This is because the markets can change fast, and you want to stay on top of any new opportunities that may arise.

Also, as previously discussed, many employers offer 401(k) plans or other employer-sponsored retirement plans. These plans offer tax advantages that can reduce the amount you need to save each month.

Making wise investments will ensure you have enough money for retirement to be comfortable in your golden years.

4. SEEK PROFESSIONAL HELP

Seeking professional help when preparing for retirement can be beneficial.

A financial planner can help you create an optimized plan that considers your individual risk tolerance, time horizon, and income needs.

Given your goals and resources, they will also guide you on the most suitable investments. They will also help you ensure that you take full advantage of the tax and other incentives available to retirees.

Professional advisers can also help you track market fluctuations, review and update your portfolio and make necessary adjustments as needed.

Seeking professional help is a wise move. Knowing you’re doing everything possible to ensure a comfortable retirement can give you peace of mind.

5. REDUCE CURRENT EXPENSES

Reducing expenses when preparing for retirement is wise - every penny saved can add up in the long run.

One of the most effective ways to reduce monthly expenses is to pay off any outstanding debt as fast as possible. This will reduce the amount you pay monthly towards debt and free up funds for other investments or savings.

You can also look at your current lifestyle and identify areas to reduce spending, such as subscriptions, services, or unnecessary purchases.

It’s important to remember that cutting back does not mean depriving yourself.

It means making sure that you are spending your money on items and services that are essential or that bring genuine value.

Reducing expenses will help you prepare for retirement more and ensure a comfortable lifestyle once you retire.

6. THINK ABOUT HEALTH CARE COSTS

Thinking about health care costs is an important part of preparing for retirement.

While you can’t predict what medical treatments and services may be needed in the future, it’s essential to plan to have the financial resources available should you need them.

Consider taking out a high-deductible health insurance plan if you are healthy and don’t expect to need much medical attention.

Alternatively, look into long-term care insurance if you are likely to need significant care in the future.

Building up a retirement fund to cover unexpected medical expenses or gaps between your insurance policy coverage and treatment costs is also wise.

Thinking about health care costs early on will help you afford the treatments or services you need when the time comes.

Healthcare costs can add up fast. So start doing your research now so you are ready when the time comes to decide about retirement health insurance.

7. CREATE A STREAM OF INCOME

Creating a steady stream of extra income when preparing for retirement is essential to ensure that your money lasts throughout.

Investing in dividend stocks, certificates of deposit, and real estate can provide you with regular, dependable annual income.

You may want to consult a financial advisor before deciding about investing. They can recommend strategies that will help you maximize your investments while ensuring the safety of your retirement fund.

Having a stable income source while retired will give you peace of mind and ensure you have enough money to enjoy your golden years.

Doing part-time work or starting a business can significantly supplement your retirement income.

Part-time jobs can help you increase your earnings and provide an extra safety net for when you retire. If you’re flexible, look into freelance or contract work that lets you pick up projects whenever possible.

You could also consider starting a business that could generate passive income while allowing you the flexibility to make decisions and control your financial future.

Doing part-time work or becoming an entrepreneur are great ways to earn more money. It can also help boost your self-confidence and sense of purpose in retirement.

8. DEVELOP A SAVINGS PLAN

Developing a savings plan is key to ensuring you have enough money for your retirement.

It's a good idea to start by creating a budget and setting aside some of your monthly income for retirement savings.

Automated transfers are an easy way to ensure that you’re saving and that any excess income goes into your retirement fund.

If you have access to a 401(K), take advantage of it by contributing as much as possible to enjoy the tax deductions associated with these plans.

Consider investments like stocks and bonds, which can help diversify your portfolio while providing some protection against inflation.

Having a sound and balanced savings plan in place will ensure there are no surprises when you retire. This will help you feel secure and in control throughout the process.

Related: 7 Money Management Tips for Beginners

9. REVIEW SOCIAL SECURITY BENEFITS

Reviewing Social Security benefits is an important part of preparing for retirement.

Social Security benefits are designed to provide financial help for individuals who are retired, disabled, or survivors of a deceased worker.

It’s a good idea to take the time to understand your eligibility and how much you can expect to receive when you reach retirement age.

This can be done by signing up for a Social Security account, which will show your estimated monthly benefits.

Also, you should look into any other programs that could supplement your social security income. These programs include Supplemental Security Income (SSI), Medicaid, Medicare, or other state-based programs.

Reviewing Social Security benefits will help ensure you have the necessary funds available when it comes time to retire.

Ensure you understand Social Security's impact on your retirement planning by reviewing your benefits as soon as possible.

10. PUT MONEY IN AN IRA OR 401(K)

Putting money in an IRA or 401(k) is a great way to prepare for retirement.

IRAs (Individual Retirement Accounts) and 401(k)s are tax-advantaged retirement savings accounts that allow you to contribute to a particular account and then receive tax breaks on those contributions.

Both provide excellent opportunities for long-term investments with the benefit of compounding interest over time.

Also, these accounts can be used as vehicles to invest in different stocks and mutual funds, which offer a way to diversify your portfolio.

With careful planning, these accounts can help ensure a secure future once you reach retirement age.

11. CONSIDER LONG-TERM CARE INSURANCE

Long-term care insurance helps to cover the costs associated with needing extended medical or custodial care, such as hiring a home health aide or living in an assisted living facility.

It pays for services that Medicare and other health insurance don’t usually cover.

When planning for retirement, it’s essential to factor in the potential need for long-term care and determine if investing in long-term care insurance makes sense.

Getting quotes from different companies can help you compare policies and find the best coverage at an affordable rate.

Considering your long-term care options will ensure you have the protection you need when it comes time to retire.

As you age, long-term care needs become more likely and expensive. So, taking out a policy now could save money in the future!

12. TAKE ADVANTAGE OF CATCH-UP CONTRIBUTIONS

Taking advantage of catch-up contributions when preparing for retirement is important in building a secure financial future.

Catch-up contributions are extra funds you can put into retirement savings accounts like IRAs and 401(k)s after you have hit the account’s annual contribution limits.

The amount you can contribute depends on the account type. Making these extra contributions can help build your retirement fund faster, saving you more money later in life.

Catch-up contributions are helpful for those 50 or older who may be behind on their saving goals since it allows them to contribute more towards their nest egg.

13. PAY DOWN DEBT

While saving for retirement is a priority, it’s important to focus on paying down any existing debt, such as credit cards, car loans, and mortgages.

Paying down the balance on high-interest-rate debts is one of the most effective strategies to free up more money for retirement savings.

Avoid taking on large amounts of consumer debt or refinancing a home loan with a longer-term loan. This can result in higher monthly payments or could further strain your personal finances during retirement.

You can enjoy a secure future by reducing existing obligations and prioritizing retirement savings.

Related Articles:

How to Pay Off Debt with Low Income

14. CREATE RETIREMENT GOALS

Creating retirement goals is an important part of preparing for retirement. Setting clear, attainable goals will help you stay on track as you save and plan.

Consider your current financial situation, age, and lifestyle when creating these goals to ensure they’re realistic and achievable.

Also, make sure to revisit your goals to adjust them as needed.

It’s also important to remember that retirement planning should be flexible.

Unexpected life events can affect how much money you need or when you want to retire.

Creating retirement goals gives you a roadmap for your financial future. It also helps keep you motivated throughout the process.

CONCLUSION

Preparing for retirement is a goal all of us should strive for, regardless of where we are in our financial journey.

Taking actions such as setting goals and taking advantage of catch-up contributions can maximize your savings and build a secure financial future.

Saving for retirement is essential. The good news is that it doesn't have to be overwhelming.

Even small contributions can make a big difference over time.

If you’re just starting out, save as much as possible through your employer-sponsored plan or by opening an individual retirement account (IRA).

Staying consistent with your savings and investment strategies will help ensure you have the resources necessary to enjoy a comfortable retirement.

Various tools, such as online calculators or working with a financial advisor, are available to make the process easier.

Regardless of your approach, preparing now will allow you to enjoy the comfortable retirement you have always dreamed of.