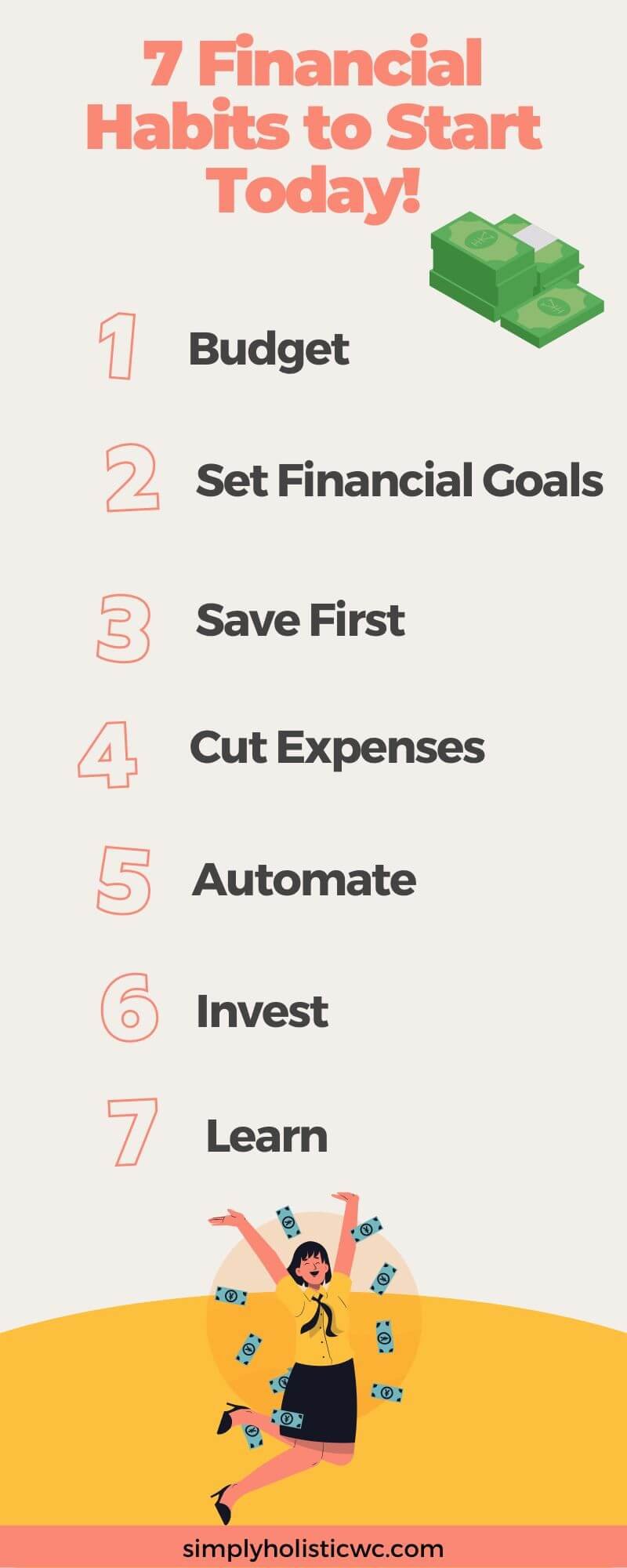

7 Financial Habits to Start Today

Money: it’s something most of us think about every day, whether we like it or not.

Unfortunately, managing our finances can be tricky – especially if you’ve never had a comprehensive plan for doing so.

But the good news is that financial success isn’t an insurmountable task; small habits can go a long way when it comes to achieving your money goals.

In this blog post, get ready to learn seven simple habits that will help you take control of your finances and start reaching financial freedom today!

This post may contain affiliate links for which I may earn a small commission. This means shopping through these links supports my blog at no cost to you. Please read my full policy. Thank you!

7 Financial Habits to Start Today

1. Start Budgeting

Let’s kick things off with the cornerstone of financial wellness – budgeting.

It may sound like a drag, but trust me, once you get the hang of it, budgeting can be as easy as pie and as satisfying as seeing your savings grow.

So, let’s dive into some handy budgeting tips:

- Understand Your Income: Know exactly how much money you’re bringing in each month. Include all sources of income, not just your main job.

- Track Your Expenses: Keep a record of all your expenses. Yes, even that morning latte counts! You might be surprised to find out where your money is going.

- Categorize Your Spending: Divide your expenses into categories like groceries, utilities, entertainment, etc. This can help you identify areas where you might be overspending.

- Use a Budgeting App: Tools like Mint or YNAB can make budgeting easier by automatically tracking and categorizing your expenses.

- Adjust As Needed: Review and adjust your budget regularly. Life changes, and so should your budget.

Budgeting isn’t about restricting yourself – it’s about understanding your money better so you can make it work for you.

2. Set Clear Financial Goals

Next up on our financial wellness journey, we’re setting our sights on clear financial goals.

Think of it as your money’s GPS – you wouldn’t hit the road without knowing where you’re going, right? The same goes for your finances.

Let’s look at how to map out your financial journey:

- Set SMART Goals: Your goals should be Specific, Measurable, Achievable, Relevant, and Time-bound. Instead of “save more money,” try “save $3,000 for a vacation by December.”

- Short-term and Long-term Goals: Have a mix of short-term (a few months to a year) and long-term (5 years or more) goals. This can keep you motivated and provide a balance between immediate needs and future plans.

- Write It Down: Having your goals written down can make them feel more tangible and motivate you to stick to them.

- Review Regularly: Circumstances change, and so might your goals. Regularly reviewing your goals ensures they stay aligned with your current needs and aspirations.

- Celebrate Small Wins: Every time you reach a goal, celebrate! This will keep you motivated and make the financial journey more enjoyable.

Setting clear financial goals is like having a roadmap for your money. It can guide your decisions and keep you focused on what matters most to you.

So, get those goals in place and watch your financial dreams turn into reality!

You May Also Enjoy:

How to Earn Passive Income with Cryptocurrency

7 Tips to Survive a Personal Financial Crisis

10 Steps to Developing a Millionaire Mindset

3. Save Before You Spend

Now, let’s chat about a golden rule that’s simple but oh-so-powerful – Save Before You Spend.

It’s all about flipping the script on the usual “income minus expenses equals savings.” Instead, we’re making it “income minus savings equals expenses.”

Intrigued? Let’s break it down:

- Pay Yourself First: As soon as you receive your paycheck, set aside a portion for savings. This ensures you’re prioritizing your future needs.

- Set Up Automatic Transfers: Make saving effortless by setting up automatic transfers to your savings account on payday.

- Follow the 50/30/20 Rule: This budgeting rule suggests that 50% of your income should go to needs, 30% to wants, and 20% to savings. Adjust these percentages based on your personal goals and situation.

- Start Small: Don’t be discouraged if you can’t save a lot right away. Even a small amount saved regularly can add up over time.

- Consider High-Yield Savings Accounts: These offer higher interest rates than regular savings accounts, helping your money grow faster.

By saving before you spend, you’re making a conscious decision to invest in your future self.

It’s not about depriving yourself of enjoyment now, but about ensuring you have resources for later.

4. Cut Unnecessary Expenses

Now, it’s time to talk about trimming the fat off your budget – cutting unnecessary expenses. This doesn’t mean you have to live like a hermit and give up all the good things in life.

It’s about making wise decisions, prioritizing, and spending on what truly brings you joy and value.

So, let’s dive into some tips:

- Audit Your Spending: Go through your bank statements and identify expenses that aren’t essential or don’t add value to your life.

- Cancel Unused Subscriptions: If you’re paying for a gym membership but haven’t stepped foot in a gym for months, it might be time to cancel.

- Cook at Home More Often: Eating out can be expensive. Try cooking at home more often, and make it fun by trying out new recipes or cooking with friends and family.

- Shop Smart: Use coupons, buy in bulk, or wait for sales when shopping for non-perishable items.

- Consider Alternatives: Instead of buying books, see if they’re available at your local library. Use public transportation or carpool instead of driving when possible.

Remember, cutting unnecessary expenses isn’t about depriving yourself, but about making smart choices that align with your financial goals.

It’s about finding a balance between enjoying the present and preparing for the future.

5. Automate Your Finances

Next on our financial wellness checklist is a modern marvel – automating your finances.

This is about letting technology do the heavy lifting for you, making managing money less time-consuming and reducing the risk of human error.

Sounds pretty neat, doesn’t it?

Let’s explore how you can automate your finances:

- Automatic Bill Pay: Set up automatic payments for your recurring bills to avoid late fees and protect your credit score.

- Direct Deposit: Have your paycheck directly deposited into your bank account. Some employers even allow you to split your paycheck between different accounts.

- Automated Savings: Set up automatic transfers to your savings or investment accounts every month. This aligns perfectly with our ‘save before you spend’ mantra!

- Use Budgeting Apps: There are many apps that can track your spending, create budgets, and even automatically save small amounts for you.

- Automate Investments: Use robo-advisors or automatic contributions to your retirement or investment accounts.

Automating your finances isn’t about being hands-off with your money. It’s about using tools to help manage your money more efficiently, so you can focus on the fun parts of life.

So, set it, forget it, and let automation make your financial journey smoother!

You May Also Enjoy:

100 New Year’s Resolutions for Health and Wealth

6. Invest Regularly

Time to talk about a habit that can set you up for long-term financial success – investing regularly.

Investing isn’t just for the wealthy, and it’s not about getting rich quick. It’s about growing your wealth over time and making money work for you. Ready to get started?

Here are some tips:

- Start Small: You don’t need a lot of money to start investing. Many platforms allow you to invest with as little as $5.

- Invest Consistently: Make regular contributions to your investment accounts, regardless of market conditions. This is known as dollar-cost averaging.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Spread your investments across different asset classes to spread risk.

- Take Advantage of Employer Match: If your employer has an option for a 401(k) match, contribute at least enough to get the full match. It’s essentially free money!

- Be Patient: Investing is a long-term game. Don’t panic when the market dips and don’t expect immediate returns.

Investing regularly isn’t about timing the market, it’s about time in the market. So start today, invest consistently, and watch your wealth grow over time!

7. Learn About Money

Now, let’s chat about something that’s often overlooked but is so important – continually learning about money.

Financial education isn’t just for finance professionals; it’s for everyone! When you understand how money works, you can be empowered to make better financial decisions.

So, how can you expand your financial knowledge?

Here are some ideas:

- Read Books: There are tons of great books out there that can help you learn about personal finance, investing, and more. Check out these books to get you started!

- Listen to Podcasts: Financial podcasts can be a great way to learn on the go. Plus, there’s a podcast out there for nearly every financial topic you can think of!

- Take Online Courses: Many online platforms offer courses on personal finance and investing. Some are even free!

- Follow Financial Blogs: There are many blogs that offer advice on everything from saving money to investing in stocks.

- Join Financial Communities: Online communities, like forums or social media groups, can be a great place to learn from others’ experiences and ask questions.

When it comes to your finances, knowledge truly is power.

So make a commitment to never stop learning and watch as your financial health improves along with your financial IQ!

Wrapping Up

Developing good financial habits is a journey that starts with simple steps.

Whether it’s automating your finances, investing, or learning about money, each habit you cultivate brings you one step closer to financial freedom.

Remember, the key to success lies not in making grand gestures but in consistent, small actions taken daily.

So start today, and build a financially secure future, one habit at a time. Your future self will surely thank you!

References:

https://www.forbes.com/advisor/investing/cryptocurrency/what-is-cryptocurrency